Columbia MO Home Loans: Your Guide to Securing a Mortgage

Obtaining a home loan in Columbia, MO, can be a straightforward process if you understand the steps involved and know what to expect. Whether you are a first-time homebuyer or looking to refinance, this guide will provide essential information to help you navigate the process.

Understanding Home Loans

Home loans, also known as mortgages, are financial agreements that allow individuals to purchase real estate. They come with various terms and interest rates that can affect your monthly payments and overall cost.

Types of Home Loans Available

- Conventional Loans: These are not insured by the government and typically require a higher credit score.

- FHA Loans: Insured by the Federal Housing Administration, these loans are ideal for first-time buyers with lower credit scores.

- VA Loans: Available to veterans and active military members, these loans often require no down payment.

- USDA Loans: Designed for rural property buyers, these loans offer low interest rates with no down payment.

Steps to Secure a Home Loan

- Assess Your Financial Situation: Review your credit score, debt-to-income ratio, and savings to determine your loan eligibility.

- Get Pre-approved: A pre-approval letter from a lender shows sellers you are serious and financially capable of purchasing a home.

- Choose the Right Loan: Consider your options and select a loan that suits your needs and financial situation. For guidance on how to take house loan, consult experts.

- Submit Your Application: Complete the loan application process by providing necessary documentation such as income statements and employment records.

- Close the Loan: Review the loan terms, sign the agreement, and pay any required closing costs.

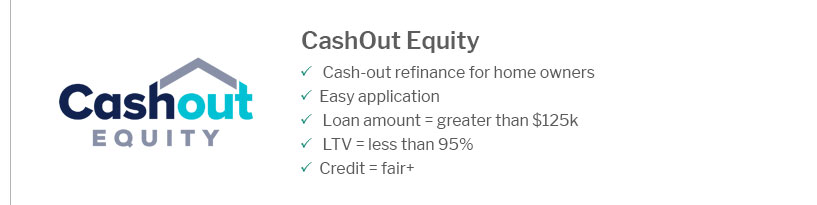

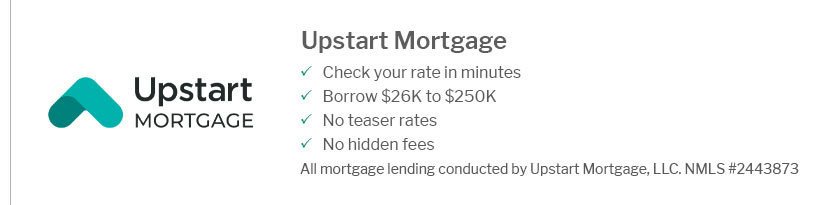

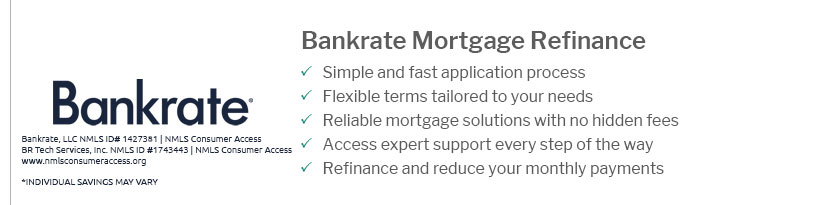

Refinancing Options in Columbia, MO

Refinancing your home loan can be a strategic move to lower your interest rates or reduce monthly payments. Consider a harp refinance with no fees to minimize costs.

Benefits of Refinancing

- Lower Interest Rates: Refinancing can help you take advantage of lower market rates.

- Change Loan Terms: Adjust your loan duration to better fit your financial goals.

- Access Home Equity: Use your home's equity for renovations or debt consolidation.

Frequently Asked Questions

What is the minimum credit score required for a home loan in Columbia, MO?

The minimum credit score for a conventional home loan is typically 620, but FHA loans may be available to those with scores as low as 580.

How much down payment is needed for a home loan?

For a conventional loan, a down payment of 20% is common, but FHA loans can require as little as 3.5%.

Can I refinance my home loan if I have bad credit?

Yes, refinancing is possible with bad credit, though it may come with higher interest rates. Consulting with a financial advisor can help explore your options.